Bayesian Gaussian Mixture Modeling for Stock Price Transformation & Prediction

Stock Price Prediction Using Bayesian Gaussian Mixture Model (BGMM)

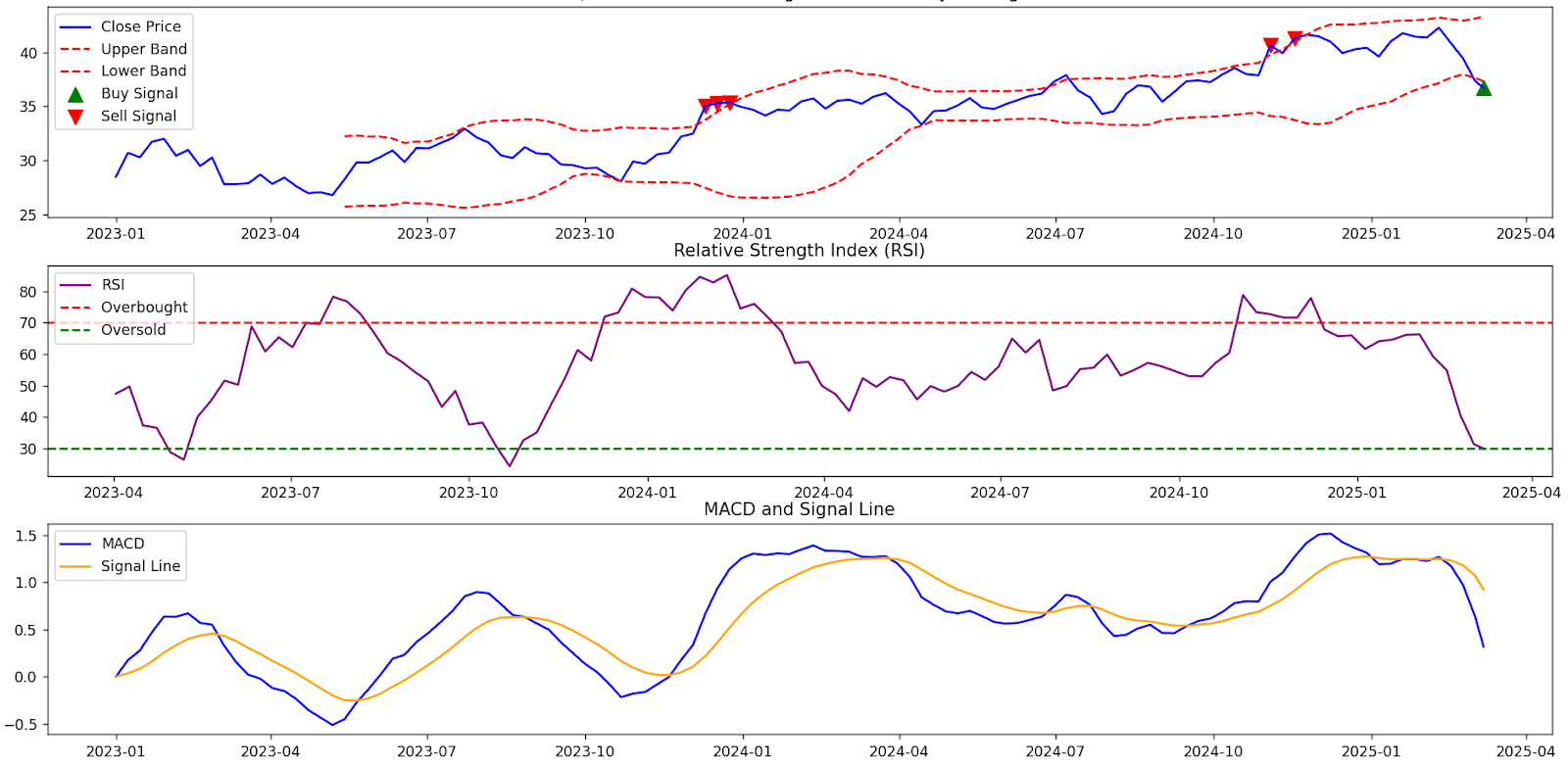

In this guide, we explore the Bayesian Gaussian Mixture Model (BGMM) and its application in transforming stock price data and generating numerical predictions. This method leverages historical stock data from Yahoo Finance, applies data transformation techniques, and fits a BGMM model to uncover hidden patterns in stock movements and make data-driven market forecasts.

The following example is presented in pseudo-code format, allowing for easy adaptation into any programming language. With modern Large Language Models (LLMs) like ChatGPT, Gemini, and DeepSeek R1, converting pseudo-code into a fully functional stock prediction script has never been simpler.

1️⃣ Fetching and Transforming Stock Data

Before applying statistical modeling, we first retrieve and transform historical stock price data.

📌 Purpose of Data Transformation

- Converts raw stock prices into a numerically transformed dataset.

- Ensures data is formatted properly for further statistical processing.

2️⃣ Bayesian Gaussian Mixture Model (BGMM) for Stock Data

A Bayesian Gaussian Mixture Model (BGMM) is a probabilistic approach used to analyze distributions within data. This function fits a BGMM model to the transformed stock data.

📌 Purpose of BGMM

- Models distributions in stock data.

- Estimates underlying statistical structure of transformed prices.

3️⃣ Predicting Future Price Movements Using BGMM

This function uses the trained BGMM model to generate numerical predictions.

📌 Purpose of Predictions

- Uses Bayesian modeling to generate numerical outputs.

- Provides relative comparisons between transformed and original prices.

4️⃣ Displaying Numerical Predictions

This function formats and displays the computed predictions.

5️⃣ Bringing It All Together

The following sequence orchestrates all components.

📜 Disclaimer: No Financial or Investment Advice

This post presents technical demonstrations related to statistical modeling and data processing.

🚨 No Investment Advice

This post does not provide financial, investment, or trading recommendations. The content is for educational and informational purposes only.

📉 No Guarantees

Any methodologies presented are for theoretical exploration and do not guarantee accuracy or financial outcomes.

📜 No Liability

The author assumes no responsibility for any financial losses resulting from the use of this information.

Always consult a qualified financial professional before making investment decisions.

🔗 Attribution and Credits

This blog post incorporates open-source tools for numerical analysis and statistical modeling.

🧠 Attribution to OpenAI & ChatGPT

This post was structured with AI-assisted explanations using ChatGPT, developed by OpenAI.

🔗 https://openai.com

📊 Attribution to Yahoo Finance

Stock data is sourced from Yahoo Finance via yfinance.

🔗 Yahoo Finance

📈 Attribution to SciKit-Learn for Bayesian Gaussian Mixture

The BGMM modeling is implemented using sklearn.mixture.BayesianGaussianMixture from SciKit-Learn.

🔗 Scikit-Learn Documentation

Comments

Post a Comment