Bayesian Gaussian Mixture Modeling for Stock Price Transformation & Prediction

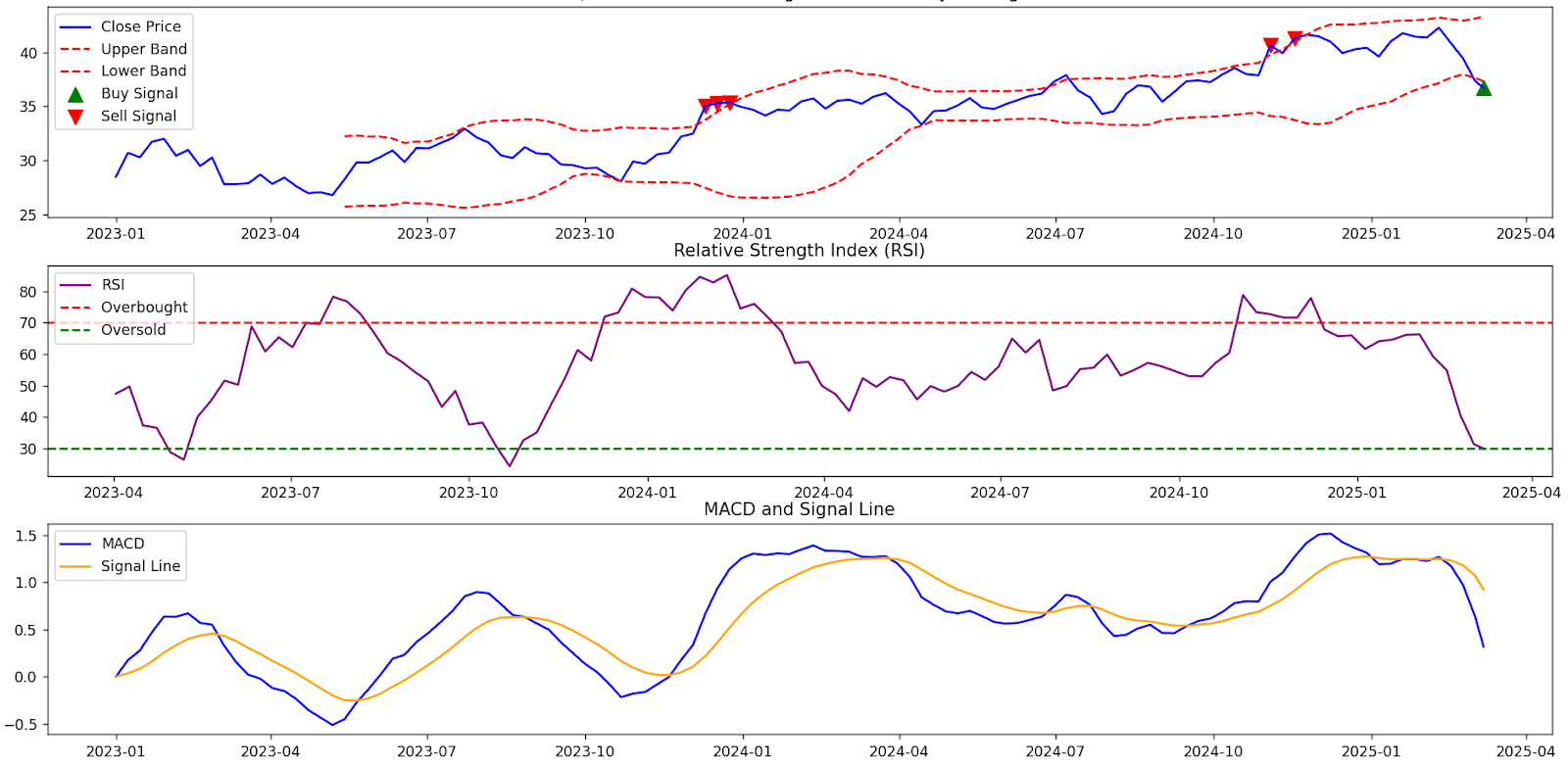

Stock Price Prediction Using Bayesian Gaussian Mixture Model (BGMM) In this guide, we explore the Bayesian Gaussian Mixture Model (BGMM) and its application in transforming stock price data and generating numerical predictions . This method leverages historical stock data from Yahoo Finance , applies data transformation techniques , and fits a BGMM model to uncover hidden patterns in stock movements and make data-driven market forecasts . The following example is presented in pseudo-code format , allowing for easy adaptation into any programming language. With modern Large Language Models (LLMs) like ChatGPT, Gemini, and DeepSeek R1 , converting pseudo-code into a fully functional stock prediction script has never been simpler. 1️⃣ Fetching and Transforming Stock Data Before applying statistical modeling , we first retrieve and transform historical stock price data. FUNCTION fetch_transformed_stock_data(symbol, start_date, end_date) TRY / / Download stock dat...